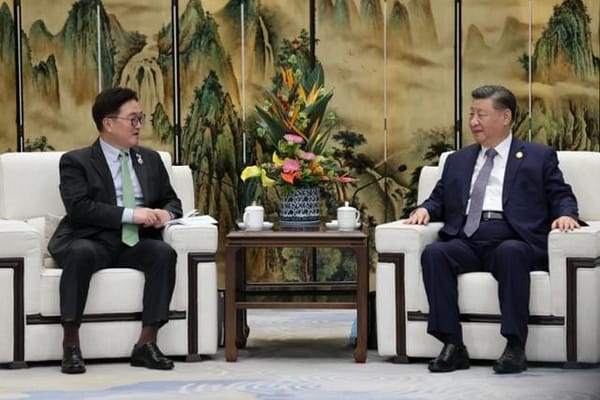

Credit: Hanwha Group.

On March 22, Hanwha Aerospace 한화에어로스페이스 announced that it would issue new shares valued KRW 3.6t (USD 2.45b), in what would be the largest transaction of its kind in South Korean history. The company forms a part of the defense contracting segment of the Hanwha chaebol 재벌 group, which has been actively expanding its capacity for international arms export.

Capital raise by new share issuance dilutes the value of shares held by existing shareholders. The drop in the share price in reaction to the announcement caused a loss of more than KRW 6t (USD 4.1b) to Hanwha Group in market capitalization, as Hanwha Aerospace share price declined by more than 13% and other Hanwha affiliates, who are expected to shell out the cash to buy Aerospace’s new shares, also suffered a loss of between 3 to 5%.

In effect, the new share issuance amounts to a reverse pump-and-dump (sometimes known as “trash-and-cash” or “poop-and-scoop,”) where a chaebol’s founding families make a decision that destroys share values and then increase their relative shareholding. Hanwha Aerospace said it required additional capital for major acquisitions, including the proposed acquisition of a stake in Austal Limited, the Australian naval ship builder. Analysts, however, criticized that Hanwha Aerospace had no reason to resort to new share issuance for a capital raise, when it could have easily borrowed the necessary funds.