Credit: Public domain.

One of the landmark legislations by the Moon Jae-in 문재인 administration was a major revision to the Income Tax Act 소득세법, which introduced the Financial Investment Income Tax 금융투자소득세. But as the FIIT is about to take effect in four months, beginning in January 2025, the Democratic Party 민주당 is pumping the brakes.

FIIT was introduced to gradually replace the Securities Transaction Tax 증권거래세, which is assessed for every stock transaction regardless of whether the transaction made a profit. Under the new system, a tax between 5% to 27.5% would be assessed on the profit made from selling stocks and other securities above KRW 50m (USD 37.5k), while the STT would be gradually eliminated.

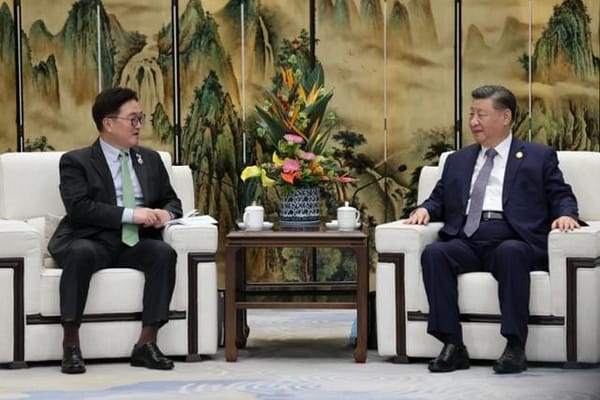

The implementation of FIIT, originally scheduled for 2022, was delayed once already as it was criticized for applying only to individual investors while exempting institutional investors. At the September 1 meeting between the heads of two major parties, People Power Party chairman Han Dong-hun 한동훈 국민의힘 당대표 continued the conservatives’ push for scrapping the law.

Democratic Party chairman Lee Jae-myung 이재명 민주당 당대표 offered a compromise, calling for a limited implementation beginning next January, arguing that FIIT is consistent with the international standard for capital markets regulation. Since his re-election as the party chairman, Lee has been moving toward the center in hopes to win back the wealthy voters in Seoul who defected en masse to the conservatives over the higher taxes under the Moon administration.